Start earning more from your money.

4.55% APY

12-Month Certificate of Deposit

$1,000 minimum deposit to open an account*

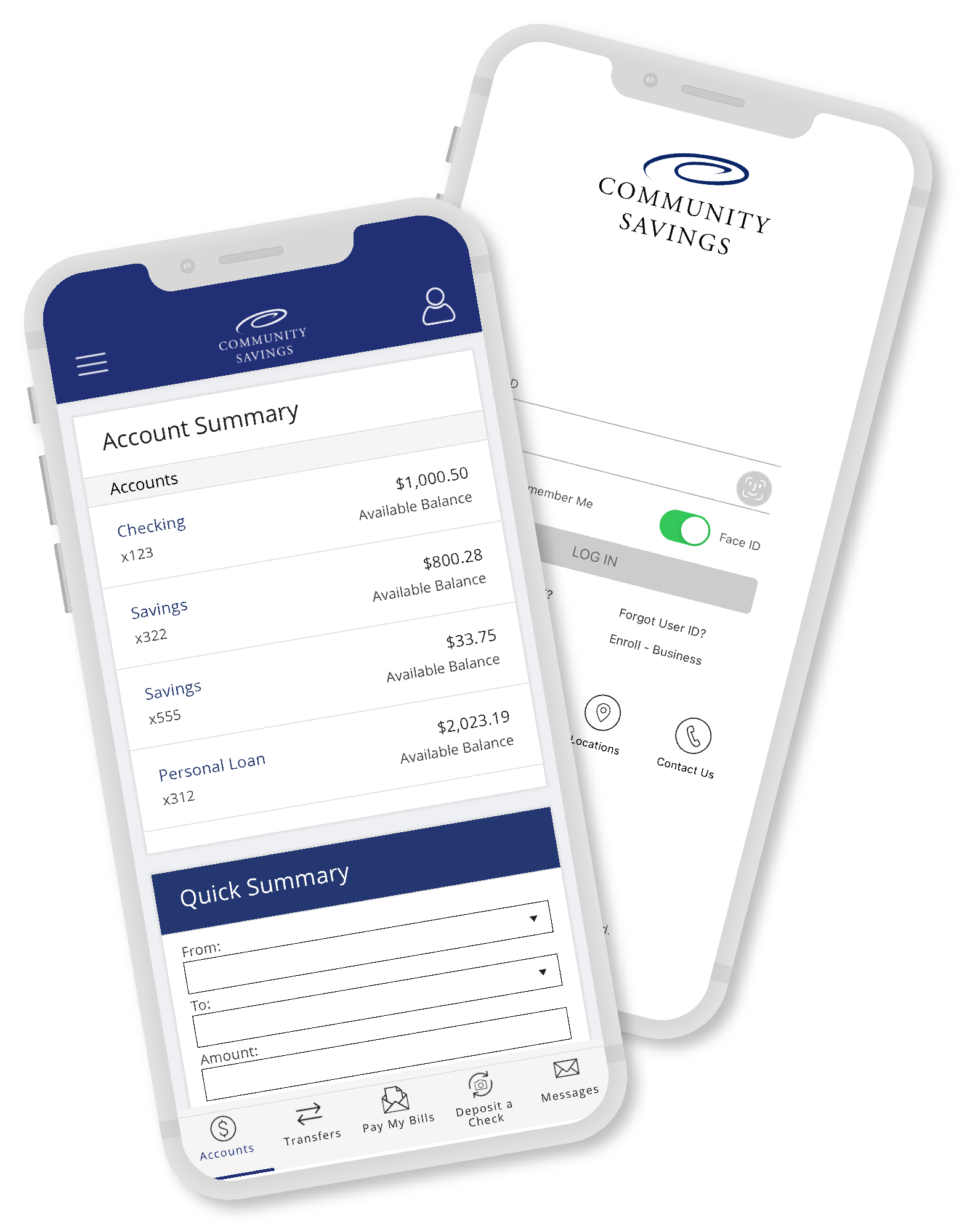

Opening Your Account is Fast & Easy

Open in Under 3 Minutes

No Microdeposit Required

Fund your account with a debit or a credit card

No ID Upload Required

Get More From Your CD Account

Guaranteed & insured returns over length of deposit.

Competitive rates to propel your savings goals.

Easy to set up and transfer funds with a debit card or ACH.

Frequently Asked Questions About CDs

Savings with Stability

Building a legacy of trust since 1885

Over a century ago, the Caldwell Building and Loan Company, now Community Savings, was founded. The bank has remained steadfast to its founding mission of serving its communities, while evolving into a modern digital bank with broad service offerings.

We began over 130 years ago and continue to play a vital role in advancing the financial growth of individuals, families, and communities across the country. It's our legacy to help you build yours.

What is a Certificate of Deposit?

A Certificate of Deposit (CD) is a type of savings account that holds a fixed amount of money for a fixed period of time, such as six months, one year, or five years, and in return, you earn interest.

How do I open a Certificate of Deposit?

You can apply online in as little as 3 minutes by clicking the "Open Online Now" button.

What are the requirements to open CD?

You must be at least 18 years old and have a tax identification number to apply.

Information Required:

- Tax Identification Number

- Home Address

- Current Email Address

- Date of Birth

- Phone Number

During your online CD application, you'll receive instructions on how to fund your account. You can fund your CD by transferring money from another bank or by using a debit or credit card.

Can I add funds to my CD at anytime?

No. You must deposit a fixed amount when you open the CD, and that amount stays locked until the CD matures. If you want to invest more funds, you can open a new CD.

Can I take money out of my CD early?

Yes, you can withdraw money from your CD (Certificate of Deposit) early, but you'll face a penalty for doing so. For more details please review the terms & conditions.

What happens at the end of my CD term?

At the end of your CD term, also known as maturity, you have a few options:

- Withdraw the money: You can take out the money along with the interest it has earned.

- Renew the CD: You can renew or roll over the CD for another term, possibly at a new interest rate.

- Transfer the funds: You can transfer the funds to another account or invest in a different financial product.

We will contact you as the end of your term approaches so you have time to make a decision.

A Bank You Can Trust

![]()

Community Savings

425 Main Street

Caldwell, Ohio 43724

©2024 Community Savings, All rights reserved.

Disclosures Privacy Notice

Equal Housing Lender NMLS ID 812294

Member FDIC Routing# 244170259